Published on January 18, 2018

A review of The Black Swan: The Impact of the Highly Improbable

Why is is that we would be shocked to find someone 55 feet tall, but we routinely hear of people making $5.6 million a year or more and think nothing of it? The former represents an individual only 10 times the average height, while the latter has a salary 100 times the average household income in the US. As Nassim Taleb explains in The Black Swan, these two quantities comes from fundamentally different realms. The first is generated by the natural world, what Taleb refers to as Mediocristan, while the second is a product of the recent technological world created by humans, Extremistan.

For nearly all of human history, we have occupied Mediocristan, where quantities are normally distributed with few values far from the average and no extreme values. Almost all phenomenon in nature behave in this manner: there are no animals that live for 10,000 years, no trees miles tall, and no humans that can run 100 miles per hour. It is only in the past century as a result of science and technological advances that we have constructed Extremistan, where outlying values such as Bill Gates’ net worth of $80 billion (about 300,000 times the average American net worth) or books sales of 500 million (the first Harry Potter) are entirely possible. These professions, computer software and creative fields, are examples of jobs that are infinitely scalable, that is, the amount of gain added does not scale linearly with the amount of effort put in. If J.K. Rowling writes a successful book that sells 10,000 copies, she does not have to put in 10 times as much effort to write a book that sells 100,000 copies. She can add another zero to the total sales with a minimal amount of effort. In contrast, traditional professions, such as baking scale linearly. In order for a baker to sell another loaf of bread, he has to bake another loaf and 10 times more sales means making 10 times as many loaves. As Taleb points out, if you want to become very wealthy, choose an infinitely scalable profession rather than a linearly scaling one where you are paid in direct proportion to the amount of hours worked.

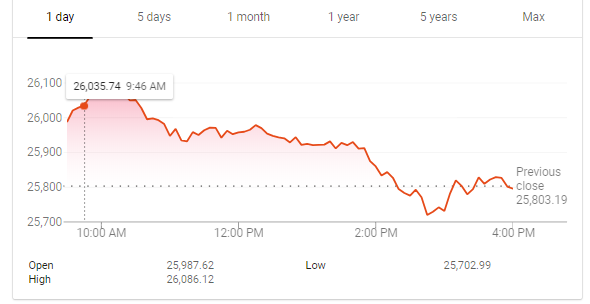

One day vs 30 years: which would you rather put your money on?

One day vs 30 years: which would you rather put your money on?

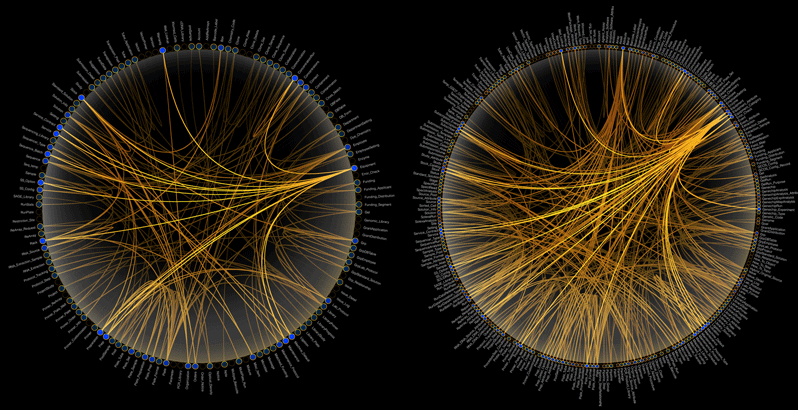

Now more than ever

Now more than ever